Introduction

As digital transactions become the norm, fraudsters are evolving just as fast. Traditional fraud detection methods—mostly static rule-based engines—are not equipped to handle modern payment dynamics. Let’s build a scalable, intelligent AI-based fraud detection system designed specifically for Payment Service Providers (PSPs).

Limitations of Traditional Rule-Based Systems

- Hard-coded thresholds are easy to bypass

- High false positives lead to poor user experience

- No ability to learn from new fraud patterns

Why AI is the Game Changer

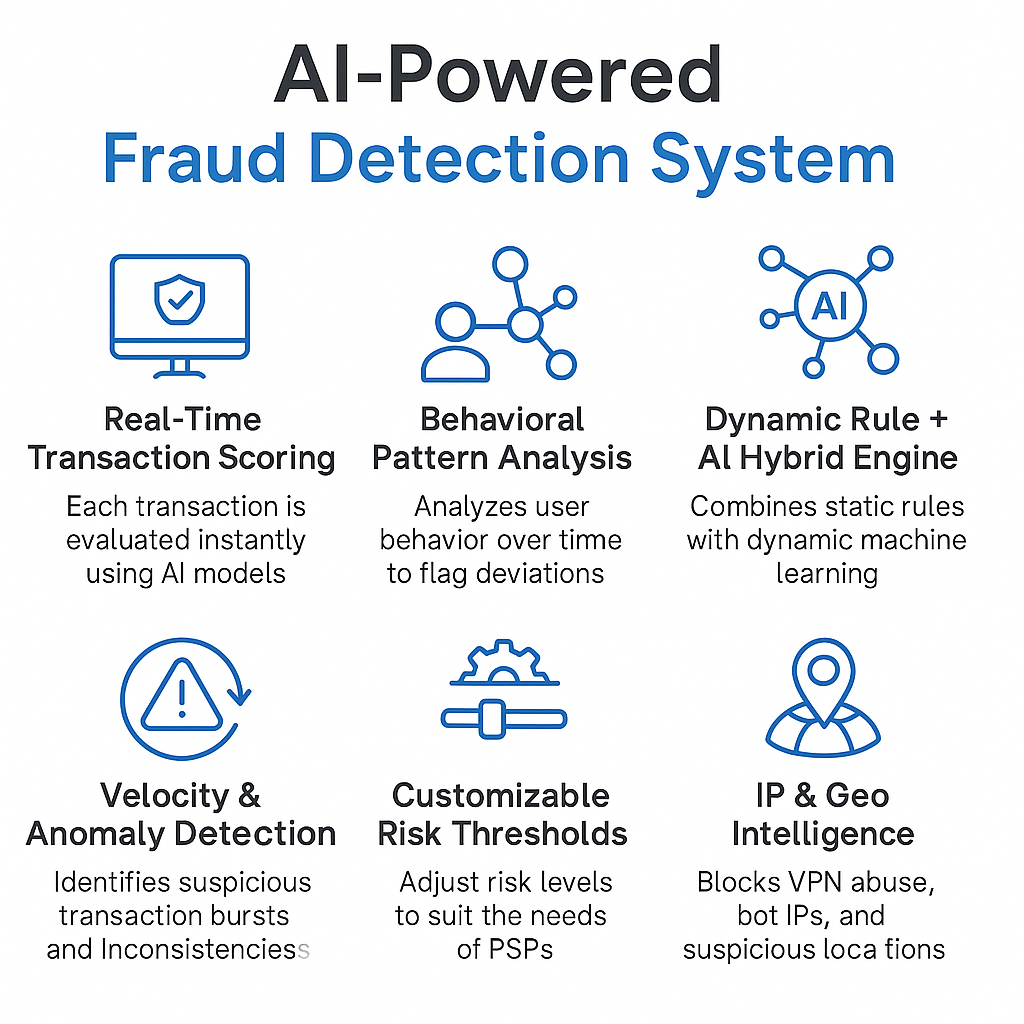

AI can learn patterns, behaviors, and anomalies dynamically—resulting in higher detection rates with fewer false alarms.

- Detects complex, hidden fraud patterns

- Real-time scoring of each transaction

- Continuously improves via feedback loops

How We Structure Our AI Fraud Detection Model

1. Data Collection Layer

We collect diverse signals from:

- Transaction Data: amount, time, currency, channel

- Behavioral Data: device changes, login times, velocity

- Geo & Device Data: IP address, GPS, OS fingerprint

- Merchant Risk Profiles: category, chargeback history

2. Feature Engineering Layer

We transform raw data into features like:

- Time since last transaction

- Deviation from usual location/device

- Merchant-level fraud frequency

3. Machine Learning Modeling Layer

Our stack includes:

- XGBoost & Random Forest for high accuracy

- Isolation Forests for anomaly detection

- Neural Networks for complex fraud patterns

4. Real-Time Risk Scoring

Every transaction is scored 0–100 with outcomes:

- Approve: safe transactions

- Review: borderline cases

- Reject: high fraud risk

5. API Integration Layer

We expose a developer-friendly REST API:

POST /api/fraud-check

{

"user_id": "U1234",

"amount": "5000",

"ip": "103.20.10.5",

"device": "Android-12"

}

6. Feedback Loop

Fraud reports and false positives are used to retrain models, improving accuracy over time.

7. Monitoring & Dashboards

- Fraud risk heatmaps

- Model accuracy reports

- Real-time alerts

Compliance First

- Fully encrypted (at rest & in transit)

- PCI-DSS and GDPR compliant

- Role-based access control (RBAC)

Technology Stack

- Backend: Python, FastAPI

- Data: Kafka, PostgreSQL

- Model Serving: Docker, Kubernetes, MLflow

- Visualization: Grafana, Metabase

Coming Next: Training and Evaluation of AI Models

In our next blog post, we’ll dive into:

- Where to find or generate real-world fraud datasets

- Preprocessing, feature scaling, and data balancing

- Evaluation metrics (Precision, Recall, F1, ROC-AUC)

- Preventing data leakage in fraud systems

- Continuous learning with feedback data

This follow-up will help data scientists and engineers understand how to build production-grade models with strong predictive .